Fueling Your Business Dreams: A Deep Dive into the Numida Loan App in Kenya

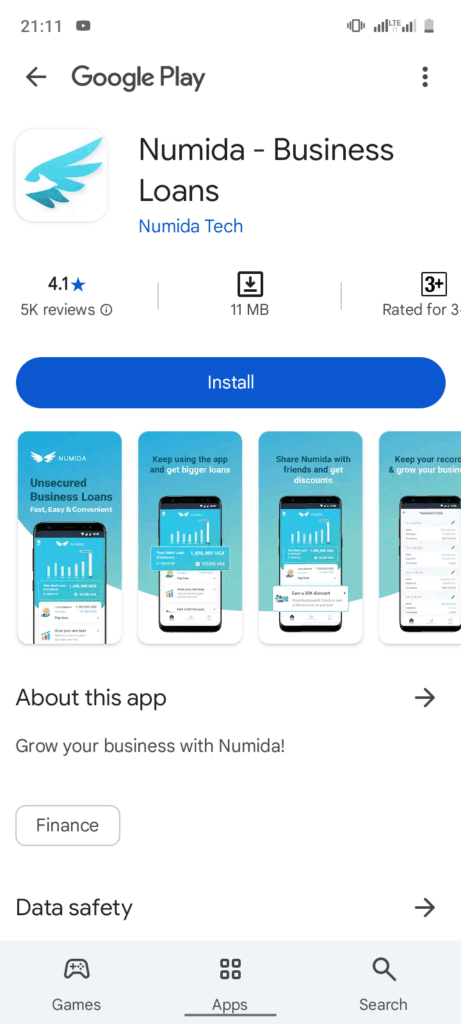

In the vibrant and ever-changing sector of Kenyan entrepreneurship, access to timely and flexible financing can be a win win situation for small and medium-sized enterprises (SMEs) towards growth and sustainability. Recognizing this vital need, several innovative platforms have emerged, offering digital lending solutions tailored to the unique demands of businesses. Among these, the Numida Loan App – initial was giving loans To Ugandans, stands out as a readily accessible tool designed to empower Kenyan business owners with the financial resources they need to thrive.

This comprehensive article will dive into the intricacies of the Numida Loan App, exploring its features, benefits, application process, repayment options, and crucial customer support details. If you are a retail or wholesale shop owner, a salon or barber shop proprietor, run a spare parts business, manage a clinic, or own a hotel in Kenya, and are seeking a reliable and instant business loan solution, then Numida might just be the partner you’ve been missing!

The Promise of Instant Business Loans

Traditional avenues for business financing can often be cumbersome, involving lengthy application processes, extensive paperwork, and significant waiting times. In the fast-paced world of Kenyan commerce, opportunities can arise and dissipate quickly. This is where instant business loan apps like Numida step in, offering a streamlined and efficient way to access capital when it’s needed most.

The Numida Loan App is specifically designed to cater to the immediate financial needs of various types of businesses. Whether you need to replenish your stock, invest in new equipment, expand your service offerings, or manage unexpected cash flow challenges, Numida aims to provide a swift financial lifeline.

Who Can Benefit? A Loan App Tailored for Diverse Businesses

Numida understands the diverse nature of the Kenyan SME sector. Their loan offerings are specifically targeted towards a range of businesses that form the backbone of the local economy. This includes:

- Retail and Wholesale Shop Owners: Secure funds to increase inventory, purchase new product lines, or manage seasonal fluctuations in demand. Imagine a shop owner needing to stock up on fast-moving consumer goods ahead of a busy market day – Numida could provide the necessary capital quickly.

- Salon and Barber Shop Owners: Invest in modern equipment, expand your shop space, purchase quality products, or even offer new services to attract more clients. For instance, a barber shop owner might need funds to buy new styling chairs or upgrade their washing basins.

- Spare Parts Shop Owners: Ensure you have a comprehensive range of parts in stock to meet customer demands, or acquire specialized inventory. Consider a spare parts dealer who needs to quickly procure a specific engine component that is in high demand.

- Clinic Owners: Obtain financing for essential medical supplies, upgrade equipment, or even manage operational costs to provide quality healthcare services. A clinic owner might need funds to purchase new diagnostic tools or replenish their stock of essential medications.

- Hotel Owners: Manage operational expenses, invest in renovations, or cater to seasonal demands in the hospitality industry. For example, a hotel owner might need funds to refurbish rooms or hire additional staff during peak tourist seasons.

By focusing on these key sectors, Numida demonstrates a clear understanding of the specific financial needs and growth aspirations of these businesses.

Loan Limits and Interest Rates: Understanding the Numbers

Transparency in lending is crucial, and Numida provides clear information regarding their loan limits and interest rates:

- Loan Amounts: Borrowers can access loans ranging from KES 5,000 to KES 300,000. This range caters to the varying financial requirements of different business sizes and needs. A small retail shop might opt for a smaller loan to replenish stock, while a growing hotel could seek a larger amount for renovations.

- Repayment Period: The standard loan repayment period is 30 days. This short-term structure is designed to align with the typical cash flow cycles of many small businesses.

- Interest Rate: The interest rate is stated as 25% per month. It’s important for potential borrowers to carefully consider this rate and factor it into their repayment planning to ensure the loan is manageable within their business’s financial capacity. While this rate might seem high at first glance, it’s crucial to compare it with the urgency and convenience offered by instant loan apps, as well as the potential returns the borrowed capital can generate for the business within that timeframe.

Getting Started: A Simple Application Process

| Loan Limits | kes 5000 ~ 300,000 |

| Interest rates | 25% per month |

| Repayment period | 30 days |

| Customer support | phone: +254 704454031 |

Numida has streamlined the loan application process to be quick and user-friendly:

- Registration: Once the app is downloaded, you will need to register using your personal details. This typically involves providing your name, phone number, national identification details, and information about your business.

- Tap “Apply Loan”: After successful registration, navigate within the app and select the “Apply Loan” option.

- Complete the Application: You will be prompted to fill in a loan application form, which will likely require details about your business, the amount you wish to borrow, and the purpose of the loan. Be accurate and provide all the necessary information to facilitate a smooth process.

- Await Contact: Once your application is submitted, the Numida Loan team will review it. They will then contact you to discuss your application further, potentially request additional information, and inform you of the outcome.

This straightforward process eliminates the need for physical visits to financial institutions and reduces the turnaround time significantly.

Effortless Repayment: Convenient Options at Your Fingertips

Numida offers convenient and accessible ways for borrowers to repay their loans:

- In-App Repayment: The most direct method is to repay your loan directly within the Numida Loan App. This offers a seamless and integrated experience, allowing you to manage your loan and repayments in one place.

- M-Pesa Paybill: Alternatively, you can repay via M-Pesa, Kenya’s widely used mobile money service. Use the Paybill number 4101277 (Numida Paybill). When prompted for the Account Number, enter the phone number you used to register and take out the loan. This ensures that your payment is correctly attributed to your loan account.

These flexible repayment options cater to the preferences of different users and ensure that making timely payments is as easy as possible.

Dedicated Support: Assistance When You Need It

Numida understands the importance of reliable customer support. If you have any questions, encounter any issues, or require assistance, you can reach their dedicated support team through the following channels:

- Email: Contact them via email at help@numidatech.com. This is a good option for detailed inquiries or when you need to provide documentation.

- Phone: You can also call their customer support line at +254 704 454 031. This is ideal for urgent queries or when you prefer to speak directly with a representative.

Having these accessible support channels ensures that borrowers can get the help they need throughout their loan journey.

Is Numida the Right Choice for Your Business?

The Numida Loan App offers a compelling solution for Kenyan business owners seeking quick and convenient access to capital. Its focus on specific business types, relatively straightforward application process, and flexible repayment options make it an attractive alternative to traditional lending methods.

However, it’s crucial for potential borrowers to carefully consider the interest rate and ensure that the loan terms align with their business’s financial capacity and growth projections. Thoroughly evaluating your repayment ability is essential before taking out any loan.

In conclusion, the Numida Loan App presents a valuable tool for Kenyan entrepreneurs looking to fuel their business dreams with timely financial support. By understanding its features, application process, and terms, business owners can make informed decisions and leverage this platform to unlock their growth potential in Kenya’s dynamic market.