In recent weeks, a growing number of Kenyans have come forward to warn others about a suspicious loan app known as “Xloop Loan App” that appears to be scamming users of their hard-earned money.

🛑 What is Livestreet Atelier or Xloop Loan App?

Livestreet Atelier or Xloop Loan App presents itself as a fast and easy way to access mobile loans in Kenya. Just like many other digital lending platforms, it claims to offer quick loans directly to your M-PESA with minimal registration requirements.

However, behind its glossy promises lies a well-orchestrated scam that is catching unsuspecting Kenyans off guard.

⚠️ How the Scam Works

According to multiple user reports, here’s how the scam unfolds:

- Application Process:

- Users download the Xloop app, register, and apply for a loan.

- The app asks users to pay a certain “processing” or “registration” fee via M-PESA before they can receive their loan.

- Manipulating Mobile Numbers:

- After payment, the app operators claim that the loan has been sent — but to a wrong number.

- Shockingly, the number shown is usually your original mobile number altered by just one digit.

- Another Payment Request:

- The fraudsters then ask the customer to pay another fee to ‘rectify’ the mistake or ‘re-initiate’ the transaction.

- No Loan Disbursed:

- After paying these fees, nothing is ever received.

- Any attempt to reach customer support ends in silence or automated responses.

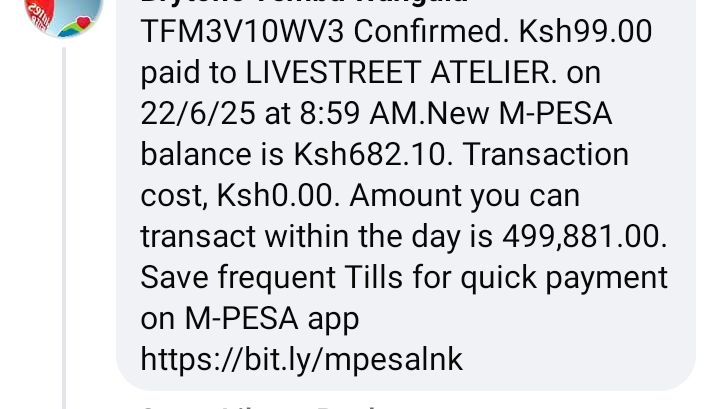

📸 Real Complaints and M-PESA Evidence

Several victims have posted screenshots of M-PESA payments made to Xloop or its agents — but no loans followed.

“I paid Ksh 350 to Xloop for processing, then they told me my loan went to another number, and I should pay Ksh 200 more to fix it. I never got anything. That’s Ksh 550 lost!”

— Anonymous Victim, Nairobi

These complaints are growing daily, shared across Facebook, Twitter, and online forums, warning others about the fraudulent behavior.

🧠 Signs Xloop Loan App is a Scam

- ❌ Requests for payment before loan approval

- ❌ Poor or fake customer support responses

- ❌ Frequently changing numbers and app versions

- ❌ Use of fake urgency or “technical errors”

- ❌ Not registered or licensed by Central Bank of Kenya (CBK)

🛡️ What You Should Do

If you suspect you’ve been scammed by Xloop or any other loan app:

- Report to DCI Kenya via their official social media or website

- File a complaint with the Communications Authority of Kenya

- *Report the number via Safaricom’s 333# platform

- Share your experience on social media to alert others

- Avoid sending money to unverified apps

🔍 Verify Before You Apply

Always ensure the loan app you’re using is:

- ✅ Listed by CBK as a licensed Digital Credit Provider (DCP)

- ✅ Has proper contacts, website, and terms

- ✅ Does not ask for money before disbursing loans

📝 Final Thoughts

The rise of fraudulent loan apps like Xloop shows the urgent need for public awareness and regulation in the digital lending space in Kenya. While many Kenyans need urgent access to cash, falling for these traps only worsens financial struggles.

Stay alert. Never pay upfront fees. Report suspicious apps immediately.

📢 Have You Been Scammed by Xloop?

Share your story in the comments or inbox us. Let’s help protect others from falling victim.