Are you in need of a fast and reliable online loan in Nigeria? The Fastcoin Loan App Nigeria might be the solution you’re looking for. With flexible loan amounts, a competitive interest rate, and a straightforward application process, Fastcoin is positioning itself as one of the rising mobile loan platforms in the country.

In this article, we provide a detailed look at Fastcoin Loan App, including its features, loan terms, how to apply, and how to contact customer support.

📌 What is Fastcoin Loan App Nigeria?

Fastcoin Loan App Nigeria is a digital lending platform that offers quick personal loans to Nigerians without collateral. It operates through a mobile app available to Android users and provides access to small to medium-sized loans within minutes.

Whether you need emergency funds for school fees, medical bills, business, or daily expenses, Fastcoin gives users an alternative to traditional banking systems, making credit more accessible for the average Nigerian.

💰 Loan Limits and Interest Rate

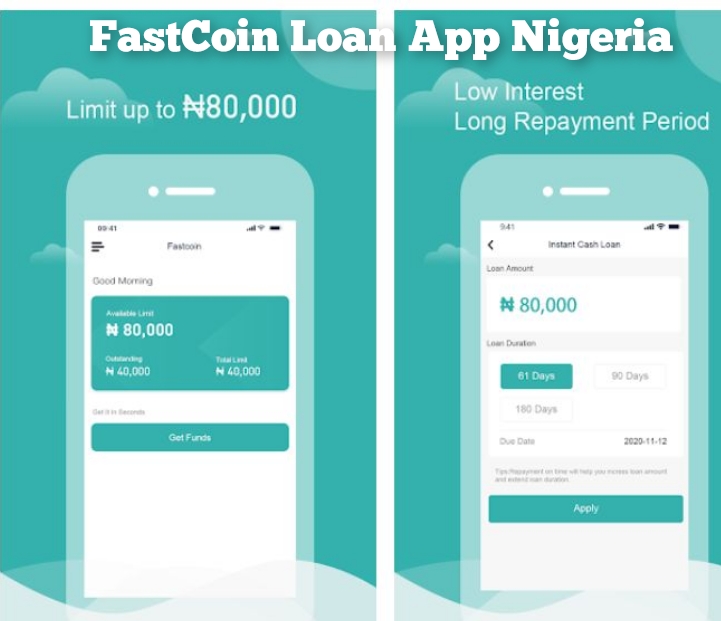

Fastcoin offers flexible loan amounts tailored to your creditworthiness and repayment history.

| Loan Feature | Details |

|---|---|

| Loan Amount | ₦2,000 – ₦80,000 |

| Interest Rate | 7.5% per month (Flat Rate) |

| Loan Term | 3 to 6 months |

| Repayment Method | Directly through the app or bank USSD |

✅ Example: If you borrow ₦10,000 for 3 months at 7.5% per month, you will pay ₦10,000 + ₦2,250 = ₦12,250 in total.

📲 How to Download and Apply for a Loan on Fastcoin

Applying for a loan with Fastcoin is quick and user-friendly. Here are the steps to follow:

Step-by-step Application Guide:

- Download the App

- Search for “Fastcoin Loan” on the Google Play Store.

- Click Install and wait for the app to download and set up.

- Register/Sign Up

- Open the app and create an account using your phone number.

- Enter your personal information such as name, BVN, and employment details.

- Apply for a Loan

- Choose the loan amount and repayment period.

- Submit your application and wait for instant approval.

- Loan Disbursement

- If approved, the loan is disbursed directly to your bank account within minutes.

💸 How to Repay Your Fastcoin Loan

You can repay your Fastcoin loan in two ways:

- Via the App

- Open the Fastcoin App and navigate to the loan repayment section.

- Select your preferred payment method (debit card, bank transfer).

- Bank Transfer or USSD

- Use the bank account or USSD details provided in the app to repay your loan manually.

⚠️ Tip: Always repay on or before your due date to avoid late payment fees and to increase your future loan limit.

📞 Fastcoin Customer Support

If you encounter any issues or have questions regarding your loan, you can reach Fastcoin customer service via:

- 📧 Email: services@fastcoinng.com

The support team typically responds within 24 to 48 hours on business days.

✅ Is Fastcoin Loan App Legit?

Yes, Fastcoin is a legitimate loan provider operating in Nigeria. While it may not be listed on the Central Bank of Nigeria’s official DML (Digital Money Lender) list yet, user reviews suggest that the app disburses loans as promised and follows a transparent interest rate structure.

However, always read their terms and conditions carefully before accepting a loan.

❓ Fastcoin Loan App – Frequently Asked Questions (FAQ)

Q1: What are the requirements to get a loan from Fastcoin?

- A valid Nigerian phone number

- BVN (Bank Verification Number)

- A bank account

- A government-issued ID may be required

Q2: How long does it take to receive the loan?

Once approved, loans are usually disbursed within 5 to 10 minutes.

Q3: Can I apply for a second loan while still repaying the first?

No. You must clear your existing loan before becoming eligible for another.

Q4: What happens if I fail to repay on time?

Late payments may attract penalties and negatively affect your credit score. Fastcoin also reserves the right to contact your emergency contacts in case of long-term default.

Q5: Is my BVN safe with Fastcoin?

Yes. Fastcoin uses your BVN to verify your identity and prevent fraud. Always ensure you download the app from the official Google Play Store.

🔚 Conclusion

The Fastcoin Loan App Nigeria is a viable choice for users seeking quick loans without the long processes associated with traditional banking. With moderate interest rates, flexible repayment plans, and fast disbursements, it’s especially suitable for salaried workers, small business owners, and students.

However, as with all digital loans, borrow responsibly and only what you can comfortably repay within the loan term.