🎓 HELB Offers 80% Penalty Waiver for Loan Defaulters in June–July 2025

The Higher Education Loans Board (HELB) has announced a significant relief measure: an 80 percent waiver on accrued penalties for loan defaulters who fully repay their outstanding student loans between 10th June and 10th July 2025.(30days)

🔹 What the Waiver Covers

- The waiver applies exclusively to penalties (late fees, interest, etc.), not the principal amount borrowed.

- It requires full and lump-sum repayment of all outstanding balances within the specified period .

🔹 How to Repay Helb Loans

Borrowers can settle their loans via multiple channels:

- Dialing USSD code *642#

- The HELB Mobile App

- The HELB online portal

- Employer check-off (for salaried individuals)

- In-person at HELB headquarters (Anniversary Towers, Nairobi) or any Huduma Centre nationwide

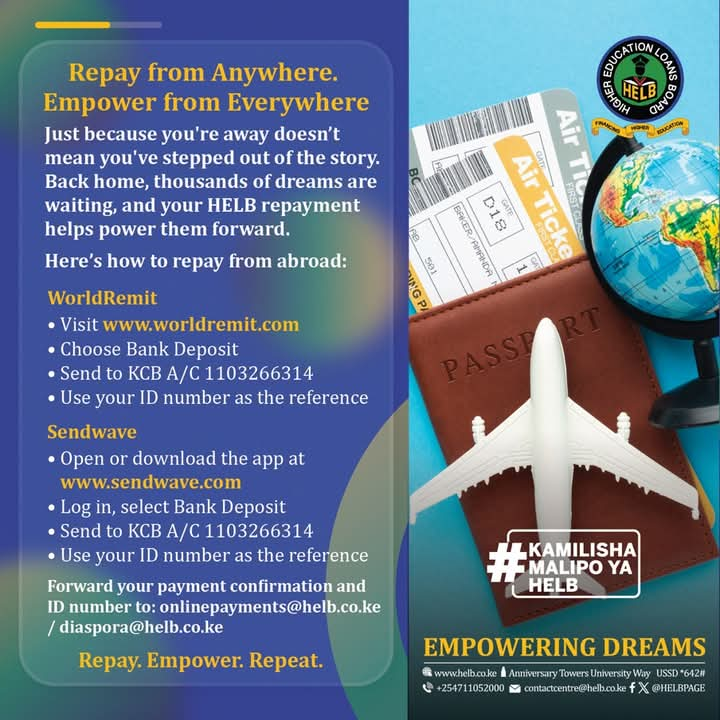

- For Diaspora worldRemit or Sandwave

🔹 Why the Push Now

- As of April 2025, HELB data shows approximately 300,000 graduates have not begun repayment, resulting in a 35 percent default rate

- Penalties on defaulters have exceeded KSh 8 billion, with some debts dating back over 20 years

- HELB CEO Geoffrey Monari emphasized that securing repayments is essential to maintain the sustainability of the loans fund and ensure future students can access financing

🔹 Context & Recovery Strategy

- Earlier in May, HELB faced criticism for proposing collaboration with police and chiefs to trace defaulters—a move they later clarified would not involve arrests, but rather partner with professional bodies and credit bureaus to encourage repayment

- Professionals like accountants, doctors, engineers, and lawyers have notably low repayment rates, whereas teachers remain the most compliant—approximately 44,000 are servicing loans actively

- HELB is working with Credit Reference Bureaus to deter defaulters from accessing financial services and may require loan clearance certificates for professional license renewals

✅ Repayment Snapshot

| Issue | Facts |

|---|---|

| Default Rate | ~300,000 defaulters (35%) as of April 2025) |

| Total Penalty Waived | 80% of penalties due if full repayment by July 2025 |

| Eligible Borrowers | Anyone with an outstanding HELB loan who can pay in full |

| Main Channels | USSD *642#, app, portal, check-off, HELB & Huduma Centres | |

🛡️ Why This Matters

- The waiver represents a “last chance” to clear debts affordably before tougher measures like CRB listing or licensing hurdles kick in

- HELB frames this campaign—tagged “Be the Reason Someone Believes”—as not only financial but also patriotic, enabling new students to benefit from returning capital

- Servicing debts responsibly helps preserve HELB’s ability to fund future cohorts and sustains the revolving funding model.

✍️ Final Thoughts

CLEARING HELB debt by July 2025 is a strategic move—it unlocks an 80% penalty waiver, helps maintain the sustainability of student funding, and avoids negative consequences like CRB listings or professional license implications. Borrowers should act promptly using the available repayment channels.