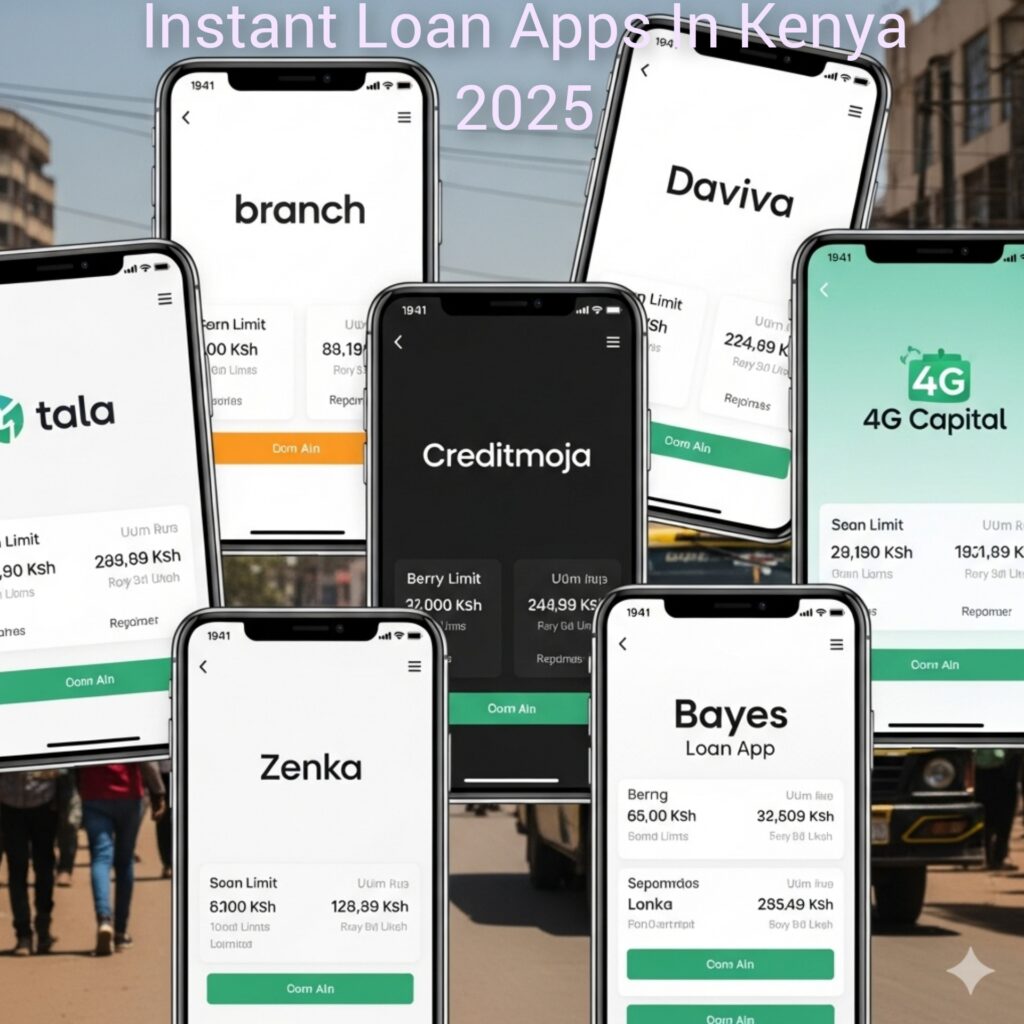

Top 20 Instant Loan Apps in Kenya 2025 – Best M-Pesa Loan Apps Without Collateral

Looking for the best instant loan apps in Kenya 2025? Mobile loans have become the fastest way to access emergency funds directly on your phone. Whether you need a quick loan of KES 500 or up to KES 150,000, there are dozens of M-Pesa loan apps approved in Kenya offering fast approvals, affordable interest rates, and flexible repayment.

In this guide, we highlight the Top 20 Instant Loan Apps in Kenya 2025, their loan limits, interest rates, repayment options, and customer support details.

1. Rocket Pesa Loan App – Loans up to KES 50,000

- Loan Amount: Up to KES 50,000

- Interest Rate: 24% APR per year

- Company: Natal Tech Limited

- Repayment: Via M-Pesa

- Customer Support: Call 0110428835

2. Daviva Loan App – Affordable Mobile Loans in Kenya

- Loan Amount: Up to KES 30,000

- Interest Rate: Low and flexible

- Repayment: Through M-Pesa

- Customer Support: Call 0111053510

3. AdvancePoa Loan App – Loans up to KES 100,000

- Loan Amount: KES 1,000 – 100,000

- Interest Rate: 40% – 80% APR

- Repayment: M-Pesa Paybill

- Customer Support: Email service@advancepoa.com

4. 4Coins Loan App Kenya – Small Quick Loans

- Loan Amount: Up to KES 5,000

- Interest Rate: 58% APR

- Repayment: M-Pesa

- Customer Support: Call 0792086491

5. Choice Sasa Loan App – High Limit Loans

- Loan Amount: Up to KES 150,000

- Interest Rate: 36.5% APR

- Company: Choice Bank

- Repayment: M-Pesa Paybill

6. True Pesa Loan App – CBK Approved Loan App in Kenya

- Loan Amount: Up to KES 100,000

- Interest Rate: 0.05% per day

- Company: Azura Credit (CBK approved)

- Repayment: M-Pesa Paybill 4092091

- Customer Support: Call 0719276399

7. FlashPesa Loan App – Fast Loans up to 80,000

- Loan Amount: Up to KES 80,000

- Interest Rate: 36% APR

- Repayment: M-Pesa Paybill 911280

- Customer Support: Call 0769159474

8. Chapaa Loan App – Fast Cash Loans

- Loan Amount: Up to KES 20,000

- Interest Rate: 10% – 15% per month

- Repayment: Through M-Pesa

- Customer Support: In-app

9. Hustler Fund Loan App – Government Loan Program

- Loan Amount: KES 500 – 50,000

- Interest Rate: 8% per year (cheapest in Kenya)

- Repayment: Auto-deduction from M-Pesa

- Customer Support: USSD code *254# or Huduma Centers

10. Berry Loan App – Quick M-Pesa Loans

- Loan Amount: KES 500 – 30,000

- Interest Rate: 10% – 15% per month

- Repayment: M-Pesa Paybill

- Customer Support: In-app chat & email

11. CreditMoja Loan App – Mobile Lending App

- Loan Amount: Up to KES 50,000

- Interest Rate: 15% – 25% per month

- Repayment: M-Pesa

- Customer Support: In-app

12. Tala Loan App – Popular Loan App in Kenya

- Loan Amount: KES 500 – 50,000

- Interest Rate: 7% – 19% depending on customer profile

- Repayment: M-Pesa Paybill

- Customer Support: In-app

13. Branch Loan App – Trusted CBK-Approved App

- Loan Amount: KES 250 – 100,000

- Interest Rate: 2% – 18% monthly

- Repayment: Via M-Pesa

- Customer Support: Email & in-app

14. 4G Capital – Business-Friendly Loans

- Loan Amount: KES 5,000 – 150,000

- Interest Rate: 15% – 25%

- Repayment: Flexible installment plans

- Customer Support: Branch offices + app

15. Bayes Loan App – Reliable Instant Loans

- Loan Amount: Up to KES 40,000

- Interest Rate: 20% – 30% monthly

- Repayment: M-Pesa

- Customer Support: App-based

16. MoCash Loan App – Fast and Easy Loans

- Loan Amount: Up to KES 25,000

- Interest Rate: 15% – 25% monthly

- Repayment: M-Pesa

- Customer Support: In-app chat

17. LinkPesa Loan App – Mobile Loan Services

- Loan Amount: Up to KES 60,000

- Interest Rate: 30% APR

- Repayment: M-Pesa Paybill

- Customer Support: Email & app chat

18. Ke Credit Loan App – Loans up to KES 100,000

- Loan Amount: Up to KES 100,000

- Interest Rate: 0.5% per day

- Repayment: M-Pesa Paybill 4089103 (Account: phone number)

- Customer Support: Call +254 719286376 | Email support@kectedit.live

19. Swift Loan App – Simple Loan Application

- Loan Amount: Up to KES 50,000

- Interest Rate: 20% – 36% APR

- Repayment: M-Pesa

- Customer Support: In-app

20. Hustler Fund Loan App – Repeat Highlight

The Hustler Fund deserves a second mention as the most affordable, government-backed loan app in Kenya with 8% interest p.a.

FAQs – Best Loan Apps in Kenya 2025

1. Which is the best loan app in Kenya 2025?

Apps like Tala, Branch, Hustler Fund, and True Pesa rank as the most reliable and affordable.

2. What is the maximum loan amount I can get?

Apps like AdvancePoa, Choice Sasa, and 4G Capital offer up to KES 150,000.

3. Which loan app has the lowest interest rate?

The Hustler Fund (8% p.a.) and True Pesa (0.05% daily) are the cheapest in Kenya.

4. How do I repay loans?

Most apps use M-Pesa Paybill numbers, while others deduct directly from your M-Pesa wallet.

5. Are these loan apps CBK approved?

Yes, True Pesa, Branch, Tala, and Hustler Fund are CBK licensed.

Final Thoughts – Best Instant M-Pesa Loans in Kenya 2025

The year 2025 has brought more regulated, affordable, and flexible loan apps in Kenya. Whether you are looking for emergency cash, business loans, or salary advances, the above 20 loan apps give you safe and instant access to credit.

Always compare loan limits, interest rates, and repayment terms before borrowing. Most importantly, only use CBK-approved loan apps to stay safe from predatory lenders.

Pingback: Senti Loan App Kenya – Quick Loans up to KES 70,000 - Loan Forest Blog

Pingback: Kes 3000 Loan In Kenya - Loan Forest Blog

Pingback: Meshke Loans Kenya – Quick Loans Made Simple in 2025 - Loan Forest Blog

Pingback: FariFari Loans Kenya – Buy Now, Pay Later Made Simple - Loan Forest Blog

Pingback: Asap Loan App Kenya – How To Get Instant Loans In Kenya - Loan Forest Blog

Pingback: Pata Hela Loan App Kenya – Get Instant Loans via M-Pesa at Low Interest Rates - Loan Forest Blog