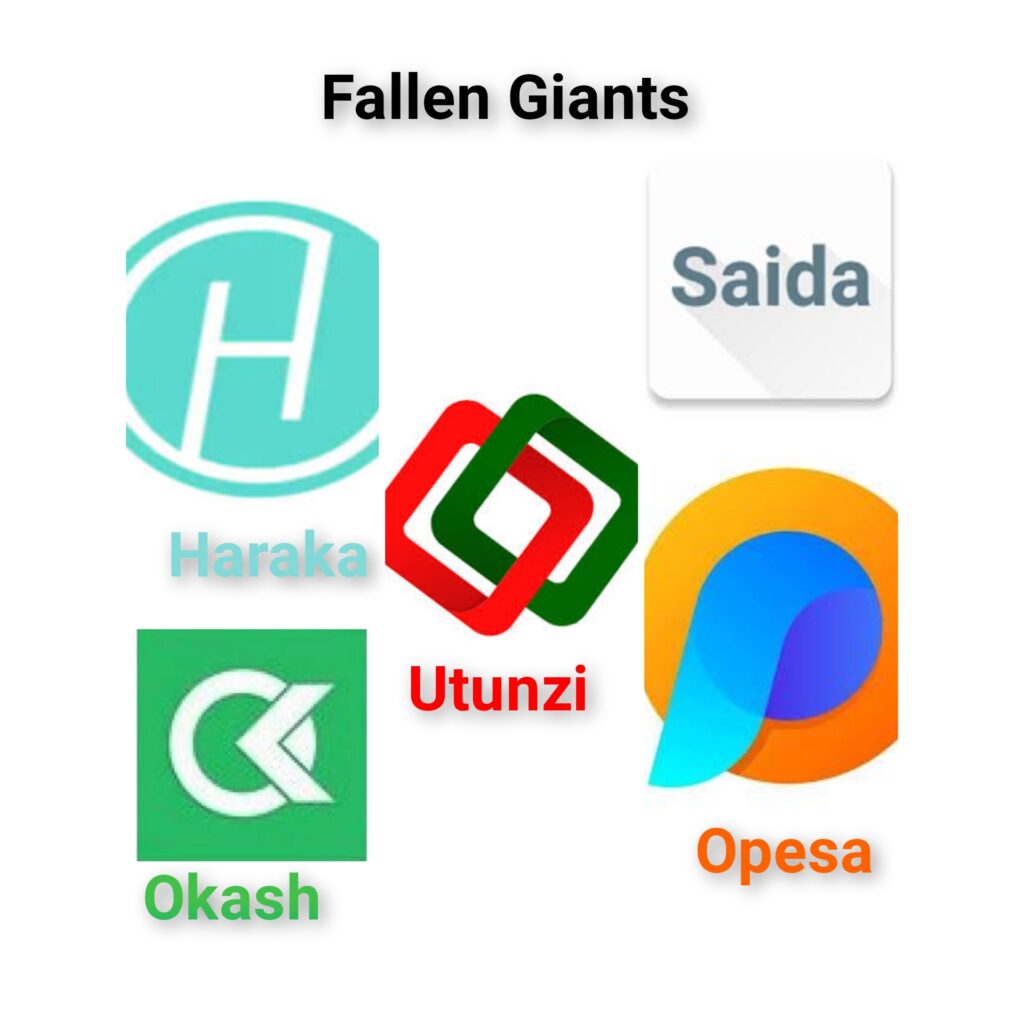

It’s fascinating how quickly the digital lending landscape can shift! You’re right, several prominent loan apps that once held significant sway in Kenya have either exited the market entirely or pivoted their business models. The departure of Haraka, Saida, Okash, Opesa, and Utunzi has undoubtedly left a void, and it’s understandable why many Kenyans would feel their absence. Let’s delve into the stories of these digital lending giants and explore the potential reasons behind their exits, as well as the impact on borrowers.

The Rise and Fall: A Look at Kenya’s Former Lending Titans

Just a few years ago, these names were ubiquitous on Kenyan smartphones. They promised quick, collateral-free loans accessible with just a few taps. This convenience resonated deeply with a population often underserved by traditional banking institutions.

- Haraka Loan App: Known for its speed and relatively straightforward application process, Haraka quickly gained traction. It offered small, short-term loans to help individuals bridge financial gaps. Its exit was perhaps one of the earlier signals of the challenges facing the digital lending sector in Kenya.

- Saida Loan App: Saida also carved a niche for itself by providing accessible loans, often targeting a similar demographic as Haraka. Its user-friendly interface and marketing campaigns made it a recognizable brand. Its disappearance from the lending scene was another blow to the availability of instant credit.

- Okash Loan App: Arguably one of the most prominent players, Okash, backed by Opera, achieved significant scale in Kenya. Its aggressive marketing and tiered loan offerings attracted a large user base. However, it eventually ceased its lending operations in Kenya, a move that surprised many given its apparent success. It’s worth noting, as you mentioned, that Okash continues to operate in other markets like Nigeria, suggesting that the reasons for its exit might be specific to the Kenyan context.

- Opesa Loan App: Another app with substantial reach, Opesa was known for its integration with the popular Opera Mini browser. This gave it a unique advantage in reaching a wide audience. Its exit from the lending business in Kenya further shrank the pool of readily available digital loans.

- Utunzi Loan App: Utunzi initially operated as a lending platform, providing quick loans to its users. However, it has since transitioned into a business records and inventory management application. This pivot indicates a strategic shift away from the direct lending model, perhaps in response to the regulatory or market challenges.

Why Did They Leave? Unpacking the Potential Reasons

The departure of these lending giants wasn’t likely due to a single factor but rather a confluence of several potential issues:

- Regulatory Landscape: The digital lending sector in Kenya has faced increasing scrutiny and regulatory changes. The push to regulate interest rates and implement stricter licensing requirements could have made the business model less profitable or more challenging for some players. The cost of compliance and the uncertainty surrounding future regulations might have prompted some to exit.

- High Default Rates: While digital lenders offered convenience, they also grappled with high default rates. The lack of traditional collateral and the ease of borrowing from multiple platforms could have contributed to borrowers struggling to repay their loans. Managing these defaults can significantly impact profitability and sustainability.

- Competition: Despite the exits, the digital lending space in Kenya remains competitive. New players and established financial institutions offering digital loan products continue to vie for market share. This intense competition could have squeezed the margins for some of the earlier entrants.

- Economic Factors: Broader economic conditions in Kenya, such as inflation and unemployment, can impact borrowers’ ability to repay loans. Economic downturns can lead to increased defaults and make the lending business riskier.

- Business Model Sustainability: The initial business models of some of these apps, focused on high-interest, short-term loans, might not have been sustainable in the long run, especially under increased regulatory pressure and with rising default rates.

- Strategic Shifts: In the case of Utunzi, the pivot to business record-keeping suggests a strategic decision to tap into a different market need. This could be driven by a perception of greater growth potential or fewer regulatory hurdles in the new domain. Okash’s continued operation in Nigeria indicates that their decision might have been specific to the Kenyan market dynamics.

The Void Left Behind: Impact on Kenyan Borrowers

The exit of these popular loan apps has undoubtedly created challenges for many Kenyans who relied on them for quick access to funds.

- Reduced Access to Instant Credit: For individuals who needed small loans for emergencies or to bridge short-term financial gaps, the departure of these apps has limited their options.

- Potential for Predatory Lending: The vacuum left by these regulated (or at least operating within the regulatory sphere) apps could potentially be filled by less scrupulous lenders, potentially exposing vulnerable individuals to predatory lending practices.

- Increased Reliance on Traditional Institutions: While traditional banks are increasingly offering digital loan products, their processes might be more stringent and less immediate than the instant loan apps.

- Impact on Financial Inclusion: Digital lending apps played a role in financial inclusion by reaching individuals who were previously unbanked or underserved. Their exit could potentially slow down the progress made in this area.

Looking Ahead: The Evolution of Digital Lending in Kenya

The story of these departing giants serves as a crucial lesson for the evolving digital lending landscape in Kenya. Sustainable growth in this sector likely requires a delicate balance between innovation, responsible lending practices, and a supportive yet robust regulatory framework.

While Kenyans may indeed miss the convenience offered by Haraka, Saida, Okash, Opesa, and Utunzi in their lending forms, the market continues to adapt. New players are emerging, and existing institutions are innovating. The future of digital lending in Kenya will likely be shaped by lessons learned from the past, a focus on customer protection, and a commitment to building sustainable and ethical financial solutions.

It will be interesting to observe how the digital lending landscape in Kenya continues to evolve and whether some of these giants might one day reconsider their positions or return with revised strategies. For now, their absence is a stark reminder of the dynamic and often challenging nature of the fintech industry.